It’s not just inflation, the COVID-19 is also feeding ‘shrinkflation’

- This topic has 8 replies, 3 voices, and was last updated 2 years, 5 months ago by

Legatus_Legionis.

Legatus_Legionis.

-

AuthorPosts

-

July 15, 2021 at 9:35 am #232810

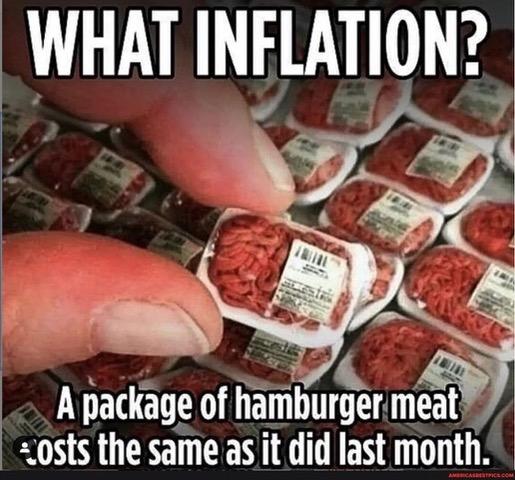

It’s not just inflation, the COVID-19 pandemic is also feeding ‘shrinkflation’

As the economy recovers from the COVID-19 pandemic, consumers are increasingly experiencing “shirnkflation” — whether they realize it or not.

And what is shirkflation?

It’s the decades-old strategy, deployed most often by food manufacturers and producers of consumer staples, of shrinking product sizes while keeping prices unchanged. And as the global ramp-up in economic activity drives up food prices and transportation costs, reports of “shrinkflation” are on the rise.

Ok, got an example.

U.S. ice cream maker Tillamook, for example, recently warned consumers in a blog post it was changing its carton size from 56oz to 48oz, while keeping the price constant, due to rising cost of ingredients. In February, Nutella-maker Ferrero similarly cited growing costs when it said it would reduce the size of jars of its world-famous nutty cholate spread in the U.K. and Belgium while keeping price unaltered. And U.S. consumers have noticed shrinking boxes of General Mills cereals just as the company warned of “pricing actions” due to rising inflationary pressures.

So, we either have to pay MORE for the same sizing, or pay the same price and get less product.

Food prices worldwide were nearly 34 per cent higher in June compared to the same month in 2020, according to the Food and Agriculture Organization of the United Nations (FAO). The cost of moving products has been soaring due to a combination of higher fuel prices and supply-chain backlogs. The cost of shipping a 40-foot container across the world has more than quadrupled since July of last year, according to one U.K. shipping consulting firm.

But isn’t that all part of the biden/kamala agenda to get us off using fuel? By making everything cost more so we would be forced to pick alternative?

Companies are offloading some of those higher costs onto clients and consumers via higher prices. Inflation in the U.S. reached a 13-year high in June, with prices up 5.4 per cent in the month compared with a year earlier.

Just what the dems wanted!

To help consumers better compare prices, many grocery stores have taken to indicate unit pricing next to package pricing. For example, the unit price a two-litre carton of milk prices at $7 is $3.5, while a 500-ml milk carton selling for $2 is priced at $4 per litre.

Yay, I look for those comparisons all the time. And the number of times the advertised “SALE” item has a greater unit price than the non-advertised item.

So like the above example, if I know for two-litre carton for $7 or I could get four 500-ml cartons at $2-each or $8 total.

July 17, 2021 at 8:58 am #233130China is responsible for this. I wouldn’t be surprised China released COVID on purpose as an attack on the West. It’s classic Art of War.

July 17, 2021 at 10:38 am #233137As a nation that manipulates its currency and wants to be a world superpower, the CCP will do anything in its power to achieve those goals… and to spread tyranny/communism like a cancer to the rest of the world.

It constantly amazing me how well one party does for the economy while the other is so inept.

July 17, 2021 at 5:26 pm #233169And to think you have people in the USA, bathed in freedom, BEGGING for communism and socialism.

August 1, 2021 at 10:36 am #235185Voters are rightly blaming Biden for inflation

An economy growing at 6.4% would be great news for most White Houses. But with inflation surging to 5.4%, many are not feeling the economic good times, and they know exactly whom to blame.

Oh, three guesses at whom that is! The first two don’t count.

54% of voters say the economy is in poor shape. In a separate Morning Consult poll, 59% of voters said Biden’s policies were to blame for the 13-year high in inflation, and 54% expect inflation to get worse.

I am surprised those numbers are so low.

The Democrats’ reaction to these numbers has been, “Damn the inflation, full spending ahead!”

Spend Spend Spend.

Damn tomorrow. Saddle the future with a debt so high it will bankrupt the nation.

At the moment, Sen. Kyrsten Sinema, the Arizona Democrat, may be the only one standing between her party and the inflationary cliff from which its members seem all too eager to jump. With Biden falsely claiming that his $3.5 trillion spendapalooza will “reduce inflation,” Sinema is pushing back against the bill’s price tag. “I do not support a bill that costs $3.5 trillion,” she told the Arizona Republic Wednesday.

A false claim by biden! ! ! And reported in the new! ! !

August 2, 2021 at 5:27 pm #235390More bad news for the dem controlled government:

The Treasury Department took initial steps to start paying off the federal government’s bills on Monday because Congress missed a July 30 deadline to either raise or suspend the debt ceiling.

Missing deadlines? It is a bad habit the government under the biden admin has been doing more and more often.

“I respectfully urge Congress to protect the full faith and credit of the United States by acting as soon as possible,” Yellen said in the letter. The nonpartisan Congressional Budget Office said in an analysis that Treasury would exhaust its special powers sometime in September or October. Absent action from Congress, the US would then default on its loans.

And what would happen if it could not?

A default from the federal government could precipitate a chain reaction of cash shortages that could hit bondholders including the people, businesses, and foreign governments who hold US debt. It could also lead to a spike in interest rates.

An increase in interest rates? Not good.

“Failure to meet those obligations would cause irreparable harm to the U.S. economy and the livelihoods of all Americans,” Yellen wrote in a letter to House Speaker Nancy Pelosi.

As if pelosi cares a damn about American livelihoods or its economy.

August 3, 2021 at 1:05 am #235400If Pelosi was the only problem we would not be in such rough shape. I would wager 90% of congress would do or say ANYTHING to gather money and power for themselves.

November 10, 2021 at 7:29 pm #248551U.S. inflation rate jumps to highest level since 1990, at 6.2%

The U.S. cost of living went up at its fastest annual pace in more than 30 years in October, new figures showed Wednesday, as the price of just about everything is increasing at a much faster pace than usual.

But I thought the current admin does not believe inflation is an issue?

While almost every single subindex was higher, the biggest factors in the record-setting jump were energy, shelter, food and new and used vehicles.

Policy makers tend to like to strip out the impact of food and energy costs from the overall inflation rate because they can be so volatile, but even by that metric, the U.S. inflation rate hasn’t been this high in 30 years. The pared-down rate came in at 4.6 per cent, which is the highest increase for everything else since 1991.

That is still HIGH!

And what is higher?

U.S. energy prices have risen by 30 per cent in the past year, the fastest pace of increase since 2005.

HHmm… stopping local energy from increasing production (and in alot of cases forced to decrease production), and stopping access from energy from your closest neighbour (Canada)… it almost sounds like this current admin HATES the American people.

After plummeting during the pandemic, inflation has come roaring back around the world for a number of factors. Chiefly, government support programs aimed at keeping people employed, coupled with low interest rates, have flooded the world with cash, which is looking for somewhere to be spent.

As is the massive spending packages they want to force onto the people if the US. Those Trillions of Dollars will not just FLOOD the market, but it will be a DELUGE the money market. The value of the green back will go down (simple supply and demand theory).

Economists and policy-makers had hoped that inflation would be “transitory,” which is an economics term that means temporary, and merely passing through due to short-term factors. But the longer inflation lasts, the more likely it is that central banks will have to start raising their interest rates sooner and faster to tame it.

With the Trillions of spending over many years, and the labour market and supply chain near the breaking point, I don’t see this as being only a short term “transitory” thing.

November 18, 2021 at 4:58 pm #249511 -

AuthorPosts

- You must be logged in to reply to this topic.